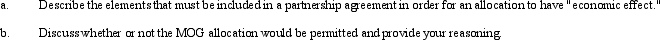

The MOG Partnership reports ordinary income of $60,000, long-term capital gain of $12,000, and tax-exempt income of $12,000. The partnership agreement provides that Molly will receive all long-term capital gains and George will receive all tax-exempt interest income. Their allocation of ordinary income will be reduced accordingly, and Olivia will be allocated a proportionately greater share of ordinary income. (In other words, each partner will receive allocations totaling 1/3 of the total $84,000 of partnership income.) This allocation was agreed upon because Molly and George are in a high marginal tax bracket and Olivia is in a low marginal tax bracket.

Definitions:

Correlational Analysis

A statistical method used to assess the strength and direction of the relationship between two or more variables without implying causation.

Q-Sort Responses

A method used in psychology to study people's subjective evaluations of items, usually involving ranking a set of items according to personal perspective.

Zero Correlation

A statistical term indicating no relationship between two variables, meaning changes in one do not predict changes in the other.

Real And Ideal Selves

This contrasts an individual's perception of their actual self with their aspirational or "ideal" self, often guiding personal development and self-improvement efforts.

Q3: Using the original information, the amount of

Q15: Will Wealth made three charitable donations in

Q19: A subsidiary can be excluded from consolidation

Q21: The accounting equation for the Proprietary fund

Q32: A partnership will take a carryover basis

Q36: Plover Corporation acquired 80% of Sink Inc.

Q39: Last year, Darby contributed land (basis of

Q49: The Internal Revenue Code is a compilation

Q77: An S corporation shareholder's basis includes his

Q127: What special adjustment is required in calculating