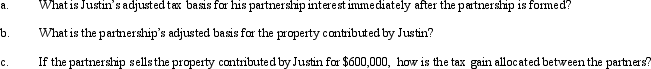

Greg and Justin are forming the GJ Partnership. Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000. The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes. Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

TVC

Total Variable Cost; the entire cost associated with producing a given output level that varies with the quantity of output.

Increasing Rate

A situation where something grows or rises in value at a progressively higher pace over time.

Marginal Cost

The expenditure associated with creating another single unit of a product or service.

Q5: List some of the separately stated items

Q21: On January 1, 2014, Parry Incorporated paid

Q32: Differences in distribution or liquidation rights among

Q33: Noncontrolling interest share for Achille is<br>A) $18,000.<br>B)

Q37: Pacini Corporation owns an 80% interest in

Q43: The maximum number of S shareholders is:<br>A)

Q91: List some techniques for reducing and/or avoiding

Q94: Which of the following is a correct

Q96: Claude Bergeron sold 1,000 shares of Ditta,

Q104: Which could constitute a second class of