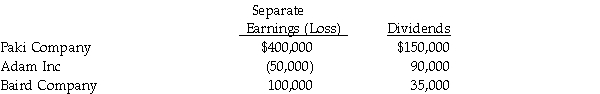

On January 1, 2014 Paki Inc. bought 75% interest in Adam Corporation. At the time of purchase, Adam owned 80% of Baird Company. In all acquisitions, the book value equals the fair value, which equals the acquisition cost. Separate earnings (loss) (excluding investment income) for the three affiliates for 2014 are as follows:

Required:

Required:

Compute controlling interest share of consolidated net income and noncontrolling interest shares for Paki and affiliates for 2014.

Definitions:

Filling

In manufacturing, it refers to the process of putting product into containers or packaging; in accounting, it could refer to completing or updating records but this usage is less direct.

Plant Assets

These are long-term tangible assets that are used in the production of goods and services and are expected to provide benefits for more than one year.

Income Statement

A financial statement that reports a company's financial performance over a specific period, displaying revenue, expenses, and net income.

Additions and Improvements

Capital expenditures made to increase the value of existing assets, often leading to a longer useful life or increased functionality.

Q9: Parrot Company owns all the outstanding voting

Q15: ABC, LLC is equally-owned by three corporations.

Q19: Which of the following business entity forms

Q26: Consolidated Interest Expense and consolidated Interest Income,

Q26: Prepare journal entries to record the following

Q29: Consolidated cost of goods sold for Pelga

Q35: Under the Uniform Probate Code, the term

Q72: What are the characteristics of an S

Q82: In a proportionate liquidating distribution, Scott receives

Q136: Janet Wang is a 50% owner of