On January 1, 2014, Paul Corporation acquired a 90% interest in Satorius Company for $360,000 when Satorius' stockholders' equity was $400,000; with Common stock of $200,000 and Retained earnings of $200,000.

On January 1, 2014, Satorius Company purchased a 10% interest in Paul Company for $90,000 when Paul's total stockholders' equity was $900,000; with Common stock of $500,000 and Retained earnings of $400,000.

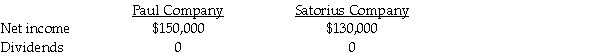

The following data was available for the year ending December 31, 2014:

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Use the conventional approach to account for the mutually-held stock. Assume there were no book value/fair value differentials for each investment. The separate net incomes do not include investment income.

Required:

1. Prepare the journal entry for Paul on January 1, 2014.

2. Prepare the journal entry for Satorius on January 1, 2014.

3. Prepare the journal entry to record the constructive retirement of 10% of Paul's outstanding stock due to Satorius' purchase of Paul's stock.

4. Determine the incomes of Paul and Satorius on a consolidated basis with mutual income for 2014 using simultaneous equations.

5. What is controlling interest share of consolidated net income and noncontrolling interest shares for 2014?

6. What is consolidated net income?

Definitions:

Q4: Pawl Corporation acquired 90% of Snab Corporation

Q15: In the business combination of Polka and

Q18: Bart Company purchased a 30% interest in

Q31: Static City started a department to provide

Q32: Differences in distribution or liquidation rights among

Q33: The following are transactions for the city

Q37: Governmental accounting differs from corporate financial accounting

Q40: What amount of unrealized profit did Pelga

Q61: What is the major pitfall associated with

Q63: With respect to passive losses, there are