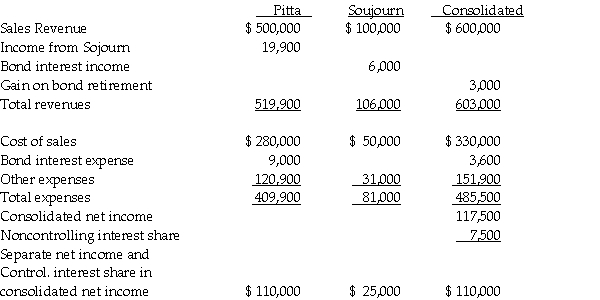

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31, 2013 are summarized as follows:

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2018. On January 2, 2013, a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2018. On January 2, 2013, a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1. Which company is the issuing affiliate of the bonds payable?

2. What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2013?

3. What portion of the bonds payable is held by nonaffiliates at December 31, 2013?

4. Is Sojourn a wholly-owned subsidiary? If not, what percentage does Pitta own?

5. Does the purchasing affiliate use straight-line or effective interest amortization?

6. Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Cohesion

The degree to which members of a group or team are united in pursuing common goals and demonstrate a sense of unity.

Valence

The intrinsic attractiveness or aversiveness of an event, object, or situation.

Group Phenomena

The various dynamic processes and behaviors that emerge when individuals interact within a group setting.

Settlement Houses

Settlement houses are community-based organizations that provide various social services and education to the urban poor, historically significant in the Progressive Era for aiding immigrants and the working class.

Q5: Julie and Kate form an equal partnership

Q17: Under the current GAAP, Goodwill arising from

Q19: On December 31, 2013, Peris Company acquired

Q27: What amount of Goodwill will be reported?<br>A)

Q28: Which type of fund is used to

Q30: A nongovernmental, not-for-profit entity is subject to:

Q33: Using the original information, the elimination entries

Q33: On July 1, 2014, Polliwog Incorporated paid

Q63: If the partnership properly makes an election

Q66: In a U.S. District Court, a jury