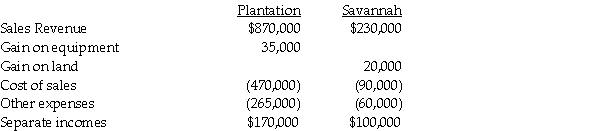

Separate income statements of Plantation Corporation and its 90%-owned subsidiary, Savannah Corporation, for 2014 are as follows, prior to Plantation recording any income related to its subsidiary:

Additional information:

Additional information:

1. Plantation acquired its 90% interest in Savannah Corporation when the book values were equal to the fair values.

2. The gain on equipment relates to equipment with a book value of $95,000 and a 7-year remaining useful life that Plantation sold to Savannah for $130,000 on January 1, 2014. The straight-line depreciation method was used and the equipment has no salvage value.

3. On January 1, 2014, Savannah sold land to an outside entity for $90,000. The land was acquired from Plantation in 2009 for $70,000. The original cost of the land to Plantation was $45,000.

4. Savannah did not declare or distribute dividends in 2014.

Required:

1. Prepare elimination/adjusting entries on the consolidated worksheet for the year 2014.

2. Prepare the consolidated income statement for the year ended December 31, 2014.

Definitions:

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that is used internationally.

U.S.GAAP

United States Generally Accepted Accounting Principles, which is a framework of accounting standards, principles, and procedures used in the U.S.

Fair Value

An estimate of the market value of an asset or liability based on current market prices or valuations of similar transactions.

Long-Term Construction Projects

Large scale construction endeavors that span over a long period, often requiring special accounting methods like the percentage-of-completion method for revenue recognition.

Q2: The partnership of Georgia, Holly, and Izzy

Q4: The City of Sill established an Internal

Q5: Thoroughgood County has a municipal golf course

Q8: The accounting equation for an agency fund

Q12: Match each of the following fund types

Q14: On December 31, 2013, Potter Corporation has

Q17: Unlike determination letters, letter rulings are issued

Q21: The City of Attross entered the following

Q34: The trust fund for a school library

Q36: The general fund trial balance for Lakeview