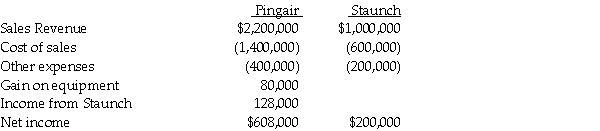

Separate income statements of Pingair Corporation and its 90%-owned subsidiary, Staunch Inc., for 2014 were as follows:

Additional information:

Additional information:

1. Pingair acquired its 90% interest in Staunch Inc. when the book values were equal to the fair values.

2. The gain on equipment relates to equipment with a book value of $120,000 and a 4-year remaining useful life that Pingair sold to Staunch for $200,000 on January 2, 2014. The straight-line depreciation method is used. The equipment has no salvage value.

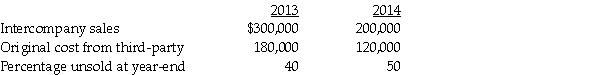

3. Pingair sold inventory to Staunch in 2013 and 2014 as shown in the table below. (The 2013 ending inventory is sold in 2014.)

4. Staunch did not declare or pay dividends in 2013 and 2014.

4. Staunch did not declare or pay dividends in 2013 and 2014.

Required:

1. Prepare adjusting/eliminating entries for the consolidation worksheet at December 31, 2014.

2. Prepare a consolidated income statement for Pingair Corporation and Subsidiary for the year ended December 31, 2014.

Definitions:

Minor

A person under the legal age of adulthood, which varies by jurisdiction, typically below 18 years old.

Apprentice

A person who is learning a trade from a skilled employer, having agreed to work for a fixed period at low wages.

Binding Written Contract

A legal document between two or more parties that is enforceable by law and outlines the terms and conditions of an agreement.

Restatement Of Contracts

A comprehensive compilation that clarifies, organizes, and illustrates the principles of contract law in the United States, helping courts and attorneys apply these principles.

Q1: Which of the following is correct?<br>A) No

Q2: Which of the following methods does the

Q9: What is the weighted-average capital for Bertram

Q10: Assume that Penguin sold the additional 3,000

Q11: If the average capital for Bertram and

Q12: Match each of the following fund types

Q16: Page Corporation acquired a 60% interest in

Q28: Noncontrolling interest share for 2013 was<br>A) $23,000.<br>B)

Q30: On January 1, 2014, Plastam Industries acquired

Q34: Anna and Bess share partnership profits and