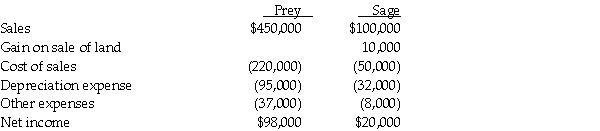

Prey Corporation created a wholly owned subsidiary, Sage Corporation, on January 1, 2013, at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000. Also, on January 1, 2013, Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000. The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method. The equipment has no salvage value. On January 1, 2015, Sage resold the land to an outside entity for $150,000. Sage continues to use the equipment purchased from Prey. Income statements for Prey and Sage for the year ended December 31, 2015 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31, 2015?

1. Gain on Sale of Land

2. Depreciation Expense

3. Consolidated net income

4. Controlling interest share of consolidated net income

Definitions:

Dependent Variable

A variable in an experiment that is expected to change in response to changes in the independent variable.

Quasi-experimental

A research design that attempts to establish cause-and-effect relationships but lacks random assignment of participants to control or experimental groups.

Correlational Investigations

Research methods that explore the relationship or association between two or more variables without determining causality.

Experiments

Controlled procedures carried out to investigate relationships between variables, often to test a hypothesis.

Q4: If the partnership agreement provides a formula

Q6: A single creditor<br>A) can never file a

Q6: The Hope scholarship credit can be explained

Q15: Assume that Pansy Incorporated used the cost

Q26: Consolidated Interest Expense and consolidated Interest Income,

Q30: Middlefield County incurred the following transactions during

Q30: Which trial court hears only tax disputes?<br>A)

Q33: In a proportionate liquidating distribution, Alexandria receives

Q36: Platinum City collects state sales taxes quarterly

Q42: The adoption tax credit can be explained