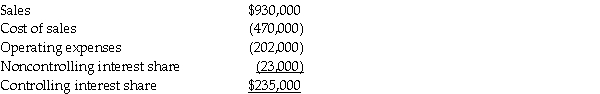

Pastern Industries has an 80% ownership stake in Sascon Incorporated. At the time of purchase, the book value of Sascon's assets and liabilities were equal to the fair value. The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets. At the end of 2014, they issued the following consolidated income statement:

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Definitions:

Recognize Faces

The ability of an individual's brain to identify and remember faces of different people.

Right Hemisphere

The right side of the brain, responsible for spatial abilities, visual imagery, and music perception, often associated with creativity.

Split-Brain Patients

Individuals who have undergone a surgical procedure called corpus callosotomy, which severs the corpus callosum, effectively splitting the brain's hemispheres and sometimes used to treat severe epilepsy.

Corpus Callosum

A large band of neural fibers connecting the two cerebral hemispheres and facilitating interhemispheric communication.

Q7: Voluntary health and welfare organizations must report

Q8: Anthony Company declared and paid $20,000 of

Q13: Which of the following are entitled to

Q22: On January 2, 2013, Pilates Inc. paid

Q28: The trial balance for the General Fund

Q28: The deduction for charitable contributions can be

Q30: Which trial court hears only tax disputes?<br>A)

Q33: Noncontrolling interest share for Achille is<br>A) $18,000.<br>B)

Q37: Gains and losses incurred at liquidation are

Q67: In a proportionate liquidating distribution in which