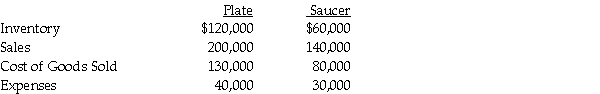

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31, 2014. Plate has owned 70% of Saucer for the past five years, and at the time of purchase, the book value of Saucer's assets and liabilities equaled the fair value. The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets. At the time of purchase, the fair values and book values of Saucer's assets and liabilities were equal.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

Required: Calculate following balances at December 31, 2014.

a. Consolidated Sales

b. Consolidated Cost of goods sold

c. Consolidated Expenses

d. Noncontrolling interest share of Saucer's net income

e. Consolidated Inventory

Definitions:

Inventory Turnover

A measure of how many times a company's inventory is sold and replaced over a certain period of time.

Interval Measure

A statistical metric used to express the amount of variance or uncertainty between data points in a series.

Receivable Turnover

A financial ratio that measures how efficiently a company uses its assets by calculating how many times a company can turn its accounts receivable into cash during a period.

Quick Ratio

A measure of a company's ability to meet its short-term obligations with its most liquid assets, calculated as (Cash + Marketable Securities + Receivables) / Current Liabilities.

Q6: If conditions produce a debit balance in

Q6: Voluntary health and welfare organizations<br>A) may not

Q8: Maxtil Corporation estimates its income by calendar

Q14: Many states have balanced budgets because laws

Q17: Pat is a 40% member of the

Q27: Proceeds from bonds issued for the construction

Q30: Pali Corporation exchanges 200,000 shares of newly

Q33: Sadie Corporation's stockholders' equity at December 31,

Q72: A partnership continues in existence unless one

Q84: The MBA Partnership makes a § 736(b)