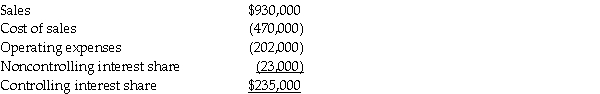

Pastern Industries has an 80% ownership stake in Sascon Incorporated. At the time of purchase, the book value of Sascon's assets and liabilities were equal to the fair value. The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets. At the end of 2014, they issued the following consolidated income statement:

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Definitions:

Clarifies Expectation

The process of making expectations clear and understandable to all parties involved.

Mutually Satisfactory Agreements

Deals or arrangements that meet the needs or preferences of all parties involved.

Leader-Member Exchange Model

A theory that emphasizes the importance of the relationship between leaders and their followers in determining organizational outcomes.

Contingent Reward-Based Practices

Systems where rewards or incentives are given to employees based on their performance or achievement of specific goals.

Q2: Wilhelman University, a not-for-profit, nongovernmental university, had

Q14: According to FASB Statement 141R, which one

Q17: Bidden, Inc., a calendar year S corporation,

Q19: On December 31, 2013, Peris Company acquired

Q29: Journalize the following utility transactions in the

Q31: Several years ago, Pilot International purchased 70%

Q31: Section 721 provides that no gain or

Q32: In reference to the determination of goodwill

Q33: Partnerships<br>A) are required to prepare annual reports.<br>B)

Q33: The City of Electri entered the following