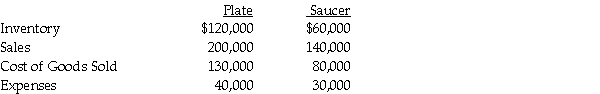

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31, 2014. Plate has owned 70% of Saucer for the past five years, and at the time of purchase, the book value of Saucer's assets and liabilities equaled the fair value. The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets. At the time of purchase, the fair values and book values of Saucer's assets and liabilities were equal.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

Required: Calculate following balances at December 31, 2014.

a. Consolidated Sales

b. Consolidated Cost of goods sold

c. Consolidated Expenses

d. Noncontrolling interest share of Saucer's net income

e. Consolidated Inventory

Definitions:

Recommendations

Suggestions or advice offered with the aim of guiding decisions or actions toward a beneficial outcome.

Work Plan

A detailed outline of tasks, activities, and timelines aimed at achieving specific goals or completing a project.

Effective Design Elements

Components or aspects of a design that significantly enhance the communication or functionality of a product or message.

Due Diligence Reports

Comprehensive reviews and analyses conducted to assess the performance, legal standings, or risk factors associated with a business or investment.

Q2: On January 1, 2013, Pilgrim Imaging purchased

Q3: What funds are reported in Government-wide financial

Q3: Eve, Fig, Gus, and Hal are partners

Q9: When preparing consolidated financial statements, which of

Q14: Under GAAP, for nonprofit, nongovernmental entities, an

Q30: A nongovernmental, not-for-profit entity is subject to:

Q35: Paula's Pizzas purchased 80% of their supplier,

Q38: In the consolidated income statement of Wattlebird

Q95: Anthony's basis in the WAM Partnership interest

Q96: Kevin, Cody, and Greg contributed assets to