Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1, 2014 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000. The amounts reported on the financial statements approximated fair value, with the exception of inventories, which were understated on the books by $500 and were sold in 2014, land which was undervalued by $1,000, and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500. Any remainder was assigned to goodwill.

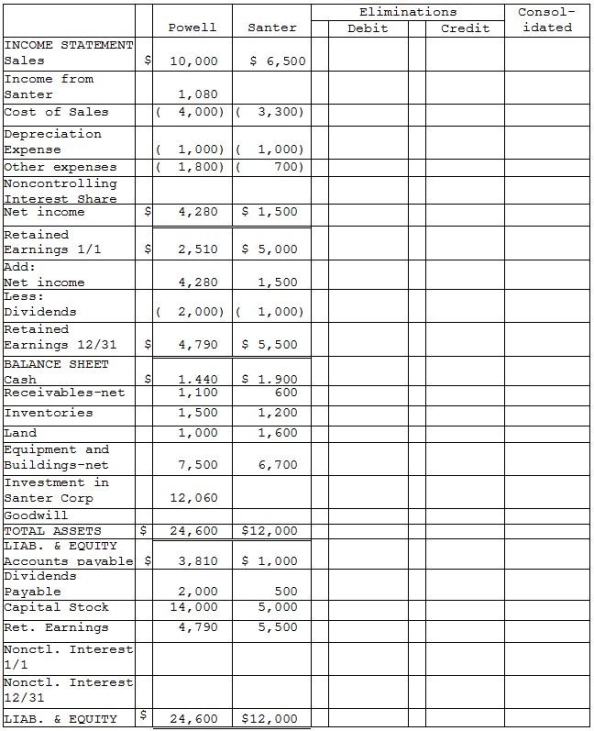

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31, 2015 appear in the first two columns of the partially completed consolidation working papers. Powell has accounted for its investment in Santer using the equity method of accounting. Powell Corporation owed Santer Corporation $100 on open account at the end of the year. Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31, 2015.

Definitions:

Everyday Activities

Routine actions or tasks that are performed daily as part of one's lifestyle and responsibilities.

Sibling Relationships

Sibling relationships concern the dynamic interactions and bonds shared between brothers and sisters, which can influence individual development, behavior, and social skills.

Noncustodial Side

Refers to the parent or guardian who does not have legal physical custody of a child in the context of divorce or legal separation.

Grandparents

The parents of one's parents, who can play various roles in the family structure, from caretakers to sources of wisdom and cultural heritage.

Q8: At the beginning of 2014, Parling Food

Q13: Proprietary funds are required to prepare financial

Q19: Palmer Corporation purchased 75% of Stone Industries'

Q24: The material sale of inventory items by

Q26: When mutually-held stock involves subsidiaries holding the

Q28: Which type of fund is used to

Q29: Consolidated cost of goods sold for Pelga

Q29: A summary balance sheet for the partnership

Q32: Paglia Corporation owns 80% of Aburn Corporation

Q87: Which of the following is an election