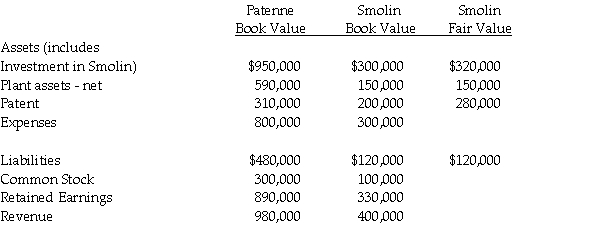

On December 31, 2014, Patenne Incorporated purchased 60% of Smolin Manufacturing for $300,000. The book value and fair value of Smolin's assets and liabilities were equal with the exception of plant assets which were undervalued by $60,000 and had a remaining life of 10 years, and a patent which was undervalued by $40,000 and had a remaining life of 5 years. At December 31, 2016, the companies showed the following balances on their respective adjusted trial balances:

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2016.

Requirement 1: Calculate the balance in the Plant assets - net and the Patent accounts on the consolidated balance sheet as of December 31, 2016.

Requirement 2: Calculate consolidated net income for 2016, and the amount allocated to the controlling and noncontrolling interests.

Requirement 3: Calculate the balance of the noncontrolling interest in Smolin to be reported on the consolidated balance sheet at December 31, 2016.

Definitions:

Positive NPV

An indication that an investment is expected to generate earnings greater than the costs, with a Net Present Value above zero, suggesting it's a profitable venture.

Projected Cash Flow

An estimate of the amount of money expected to flow in and out of a business over a future period, considering both income and expenses.

NPV

Net Present Value; a calculation used to determine the value of an investment by considering the present value of its expected future cash flows minus the initial investment cost.

Contribution Margin

The amount by which a product's sales price exceeds its total variable costs, indicating how much contribution the product makes towards fixed costs and profits.

Q1: A partnership must provide any information to

Q7: Accounts representing an allowance for uncollectible accounts

Q8: The balance sheet of the Flail, Gail,

Q15: There are several theories for allocating constructive

Q24: Plane Corporation, a U.S. company, owns 100%

Q27: Peregrine Corporation acquired an 80% interest in

Q34: Pexo Industries purchases the majority of their

Q36: Perth Corporation acquired a 100% interest in

Q51: Proposed Regulations are not published in the

Q64: A taxpayer who loses in a U.S.