Use the following information to answer question(s) below.

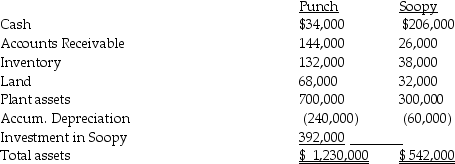

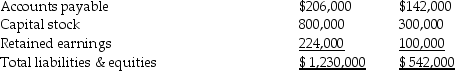

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of consolidated Retained Earnings?

Definitions:

Leased Equipment

Assets obtained by a company through a leasing agreement, allowing the company to use the equipment without owning it.

Annuity Due

An annuity due is a type of annuity payment in which each installment is paid at the beginning of each period, rather than at the end, typically used in leases and loan repayments.

Capital Lease Obligation

A lease classified as a purchase agreement for accounting purposes, wherein the lessee records the leased asset as an owned asset on the balance sheet.

Capital Lease

A lease agreement that transfers substantially all the risks and rewards of ownership of the asset to the lessee, effectively treated as a purchase of the asset.

Q6: What is Pew's income from Sordid for

Q21: Tara and Robert formed the TR Partnership

Q23: Income from patents can qualify for capital

Q24: On January 1, 2014, Singh Company acquired

Q30: Which trial court hears only tax disputes?<br>A)

Q32: A partnership will take a carryover basis

Q35: Taxes which were billed, but are not

Q37: Pond Corporation uses the fair value method

Q68: One of the disadvantages of the partnership

Q68: Rex and Scott operate a law practice