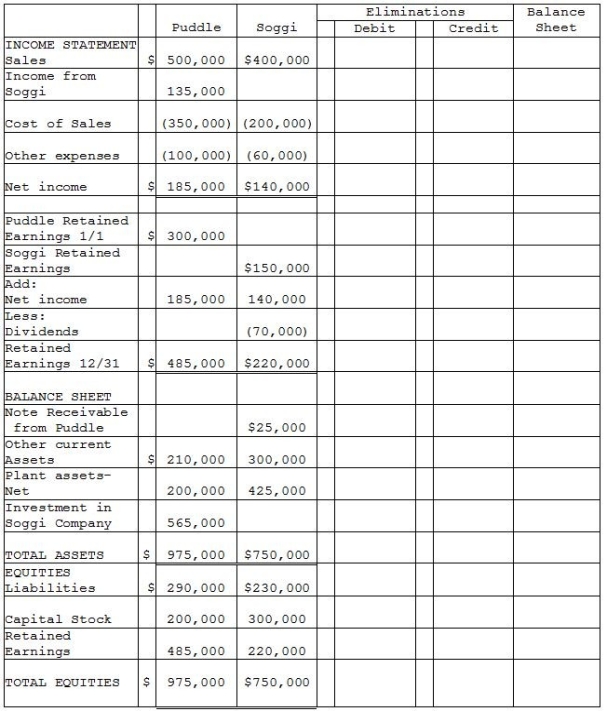

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1, 2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000. The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets. The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014, Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi, and on December 31, 2014, Puddle mailed a check to Soggi to settle the note. Soggi deposited the check on January 5, 2015, but receipt of payment of the note was not reflected in Soggi's December 31, 2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31, 2014.

Definitions:

Organizational Norms

The shared expectations and rules that guide behavior of people within an organization.

Continuous Process Improvement

A methodology aimed at identifying and implementing valuable changes to processes, enhancing efficiency and quality.

Lack of Preparation

A situation where sufficient planning and arrangement have not been made before undertaking a task or project.

Useless Meetings

Gatherings or assemblies that fail to achieve productive outcomes or objectives.

Q4: What is Goldberg's percentage ownership in Savannah

Q15: The controlling interest share of consolidated net

Q20: When a city enters into a capital

Q25: Old West City had the following transactions

Q26: When mutually-held stock involves subsidiaries holding the

Q29: Jabiru Corporation purchased a 20% interest in

Q36: The general fund trial balance for Lakeview

Q38: Required:<br>1. Prepare a schedule to allocate income

Q78: Harry and Sally are considering forming a

Q93: Erika contributed property with a basis of