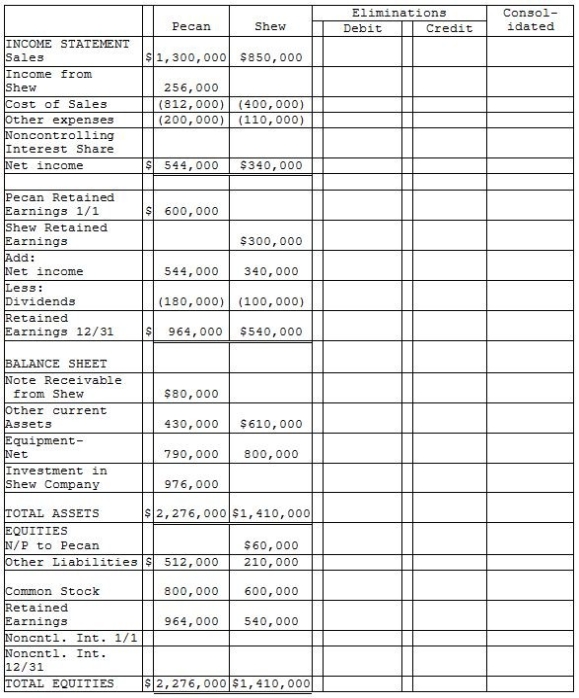

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2, 2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000. The book value and fair value of Shew's assets and liabilities were equal except for equipment. The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014, Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan, and on December 31, 2014, Shew mailed a check for $20,000 to Pecan in partial payment of the note. Pecan deposited the check on January 4, 2015, and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31, 2014.

Definitions:

Learning Set

The ability to become more efficient in learning new tasks based on experiences gained from learning previous tasks.

Response Set

A tendency for a person to respond to questions or situations in a patterned way, often based on habit or bias rather than thoughtful consideration.

Operant Conditioning

A method of learning that occurs through rewards and punishments for behavior, emphasizing the effect of consequences on future behavior.

Classical Conditioning

This learning strategy involves pairing two stimuli repeatedly; a response that initially comes from the second stimulus eventually comes from the first stimulus on its own.

Q2: Pal Corporation paid $5,000 for a 60%

Q2: Which of the following methods does the

Q3: A newly acquired subsidiary had pre-existing goodwill

Q10: Petra Corporation paid $500,000 for 80% of

Q13: If an affiliate purchases bonds in the

Q16: In reference to estates, which of the

Q20: Paco Corporation owns 90% of Aber Corporation,

Q26: If Bird uses the "actual-sale-date" sales assumption,

Q28: The following data relate to Elle Corporation's

Q34: Regulations are issued by the Treasury Department.