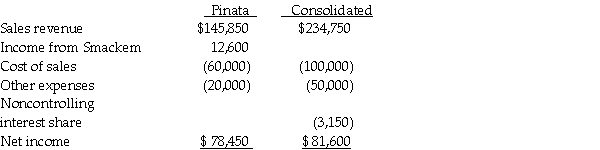

Pinata Corporation acquired an 80% interest in Smackem Inc. for $130,000 on January 1, 2014, when Smackem had Capital Stock of $125,000 and Retained Earnings of $25,000. Assume the fair value and book value of Smackem's net assets were equal on January 1, 2014. Pinata's separate income statement and a consolidated income statement for Pinata and Subsidiary as of December 31, 2014, are shown below.  Smackem's separate income statement must have reported net income of

Smackem's separate income statement must have reported net income of

Definitions:

Contribution Margin

The amount remaining from sales revenue after variable expenses have been deducted.

Segment Margin

The amount of profit or loss generated by a specific segment of a business, after deducting direct and allocated expenses attributable to that segment.

Common Fixed Expenses

Expenses that do not vary with the level of production or sales and are typically required to run a business, such as rent, salaries, and insurance.

Variable Costing

A costing method that includes only variable manufacturing costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of goods sold, treating fixed manufacturing overhead as a period cost.

Q1: The unadjusted trial balance for the general

Q2: What is the document prepared by the

Q6: Griffon Incorporated holds a 30% ownership in

Q13: What are the key components of tax

Q14: Under GAAP, for nonprofit, nongovernmental entities, an

Q18: The accounting equation for a governmental fund

Q25: On January 1, 2014, Palling Corporation purchased

Q29: A company emerging from bankruptcy will have

Q34: When considering an acquisition, which of the

Q37: Pacini Corporation owns an 80% interest in