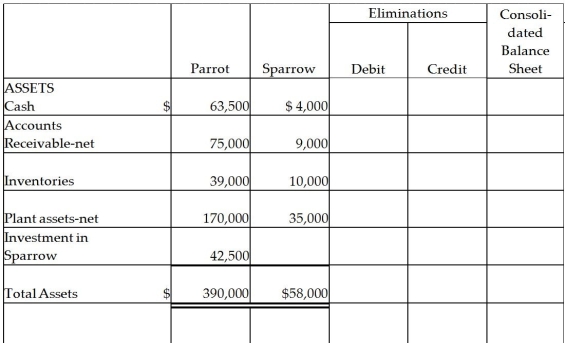

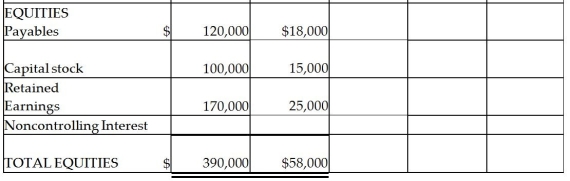

Parrot Inc. acquired an 85% interest in Sparrow Corporation on January 2, 2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000. Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000. Balance sheets for Parrot and Sparrow on January 2, 2014, immediately after the business combination, are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1, 2014.

Definitions:

Systems Perspective

An approach to analysis that considers the interconnectedness and interactions between the components of a system.

Strategic Decisions

Choices made by an organization's management that have long-term implications and are crucial for achieving overarching goals.

Succession Planning

The process of identifying and developing new leaders who can replace old leaders when they leave, retire, or pass away.

Self-awareness

The ability to reflect on and accurately assess one's own behaviors, attitudes, and impacts on others.

Q8: Cirtus Corporation, a U.S. corporation, placed an

Q9: In reference to the probate process, which

Q11: The following are transactions for the city

Q15: Which of the following is a reason

Q15: Will Wealth made three charitable donations in

Q26: What goodwill will be recorded?<br>A) $ 80,000<br>B)

Q27: Faled Company has the following assets and

Q30: Aaron owns a 30% interest in a

Q30: What is an advantage of filing a

Q83: The December 31, 2011, balance sheet of