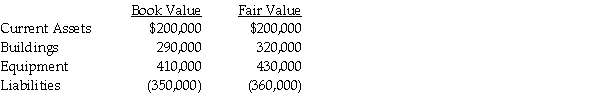

Passcode Incorporated acquired 90% of Safe Systems International for $540,000, the market value at that time. On the date of acquisition, Safe Systems showed the following balances on their ledger:

Safe Systems has determined that their buildings have a remaining life of 10 years, and their equipment has a remaining useful life of 8 years.

Safe Systems has determined that their buildings have a remaining life of 10 years, and their equipment has a remaining useful life of 8 years.

Requirement 1: Calculate the amount of goodwill that will appear on the general ledger of Passcode and Safe Systems, as well as the amount that will appear on the consolidated financial statements.

Requirement 2: Calculate the amount of amortization that will appear on the consolidated financial statements for buildings and equipment, and explain how this amortization of excess fair value is shown on the separate general ledgers of Passcode and Safe Systems.

Definitions:

Personalized Offerings

Customized products or services designed to meet the specific needs or preferences of an individual customer.

Rapid Delivery

A service process that ensures products or goods are delivered to the customer promptly, often within the same day or a few hours.

Repeat Business

The phenomenon of customers consistently returning to purchase the same product or service from a business.

Omnichannel Retailers

Retailers that provide a seamless customer experience across multiple channels, including online and physical stores.

Q1: Stephanie receives a proportionate nonliquidating distribution from

Q2: A summary balance sheet for the Sissy,

Q4: The balance sheets of Palisade Company and

Q5: The following are transactions for the city

Q9: The fixed assets and long-term liabilities associated

Q19: On December 31, 2013, Peris Company acquired

Q19: Alitech Corporation is liquidating under Chapter 7

Q34: In the eliminating/adjusting entries on consolidation working

Q35: Taxes which were billed, but are not

Q36: Identify the fund type of the fund