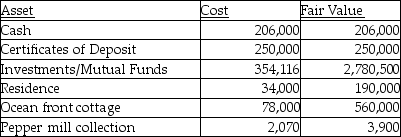

John Doe's will states that all assets he had should be transferred to a trust to cover living expenses for his spouse, who he feels will not be able to handle her own financial affairs without advice and supervision. Upon his spouse's passing, the trust will be converted to cash and distributed to their only daughter, Jane. The probate court already ruled on which assets could be excluded from the estate, and all tax issues were addressed, leaving the following inventory of assets from the estate:

Required:

Required:

Prepare the journal entry for the creation of the trust.

Definitions:

Rent Controls

Government-imposed maximums on the rent that landlords can charge tenants.

Price Ceiling

A legally imposed maximum price on a good or service, usually set below the equilibrium price to keep the goods affordable for consumers.

Equilibrium Price

The cost at which the amount of a product or service being sought matches the amount available, resulting in a stable market.

Price Ceiling

A government-imposed limit on how high the price of a product can be charged in the market to protect consumers from excessive prices.

Q1: With respect to the bond purchase, the

Q9: For each of the following transactions that

Q11: Journalize the following utility transactions in the

Q21: Oscar Lloyd is serving as the executor

Q24: A partner assigned his partnership interest to

Q31: If SOS sold the additional shares to

Q36: The amount of income for the current

Q37: The CPA examination is now computer-based with

Q40: Which of the following hedging strategies would

Q93: Erika contributed property with a basis of