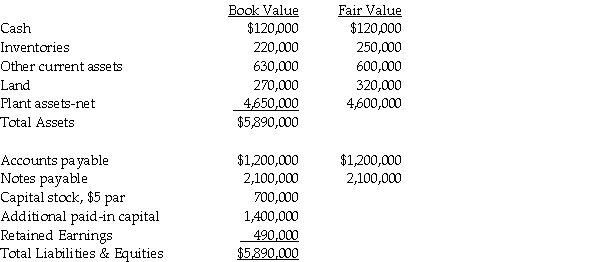

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31, 2013. Parrot borrowed $2,000,000 to complete this transaction, in addition to the $640,000 cash that they paid directly. The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below. In addition, Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow survives as a separate legal entity.

2. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow will dissolve as a separate legal entity.

Definitions:

Stages

The distinct phases or steps in a process or development, often used to describe progress in marketing, product development, or business growth.

Organizational Buying Behavior

The decision-making process and actions of organizations in the purchase of goods and services for business operations.

Organizational Buying Criteria

The standards or benchmarks that companies use to evaluate products and services for purchase decisions.

Environmental Impact

The effect that activities and actions by humans have on the natural environment, including aspects like biodiversity, pollution, and climate change.

Q3: If a sale on account by a

Q5: Which of the following is correct? The

Q18: Bart Company purchased a 30% interest in

Q18: What exchange gain or loss appeared on

Q24: Plane Corporation, a U.S. company, owns 100%

Q25: Alf, Bill, Cam, and Dot are partners

Q26: Mary Contrary is the executor for the

Q27: Pirate Transport bought 80% of the outstanding

Q61: In choosing between the actual expense method

Q144: If a taxpayer does not own a