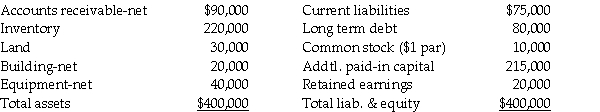

Bigga Corporation purchased the net assets of Petit, Inc. on January 2, 2013 for $380,000 cash and also paid $15,000 in direct acquisition costs. Petit, Inc. was dissolved on the date of the acquisition. Petit's balance sheet on January 2, 2013 was as follows:

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively. Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively. Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Definitions:

Q2: Assume the entity theory is used. On

Q7: Address the following situations separately.<br>1. For the

Q9: When a cash flow hedge is appropriate,

Q10: Passo Corporation acquired a 70% interest in

Q26: When mutually-held stock involves subsidiaries holding the

Q30: What should be the noncontrolling interest share,

Q30: Push-down accounting<br>A) requires a subsidiary to use

Q34: You are serving as the executor for

Q35: At December 31, 2013, the stockholders' equity

Q52: At age 65, Camilla retires from her