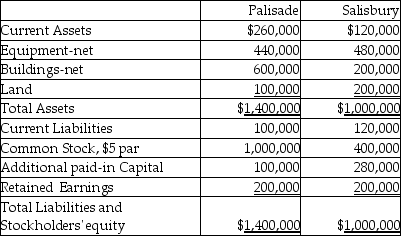

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31, 2013:

On January 1, 2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved. Palisade paid $20,000 to register and issue the new common shares. It cost Palisade $50,000 in direct combination costs. Book values equal market values except that Salisbury's land is worth $250,000.

On January 1, 2014 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares, and Salisbury was dissolved. Palisade paid $20,000 to register and issue the new common shares. It cost Palisade $50,000 in direct combination costs. Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1, 2014.

Definitions:

In-The-Money

A term describing an option contract that has intrinsic value, meaning it would be profitable to exercise the option immediately.

Call Option

A financial contract that gives the buyer the right, but not the obligation, to buy a specified quantity of an asset at a predetermined price within a specified time period.

Stock Price

The current market price at which a share of stock can be bought or sold.

Exercise Price

The price at which the holder of an option can buy or sell the underlying asset.

Q9: Distributions from a Roth IRA that are

Q9: When a cash flow hedge is appropriate,

Q19: If the bonds were originally issued at

Q25: Pogo Corporation acquired a 75% interest in

Q27: Bigga Corporation purchased the net assets of

Q29: Bailey's noncontrolling interest share for 2014 is<br>A)

Q32: On December 31, 2013, Dixie Corporation has

Q34: After graduating from college with a degree

Q38: A cash distribution plan for the Jonah,

Q122: After the automatic mileage rate has been