Use the following information to answer the question(s) below.

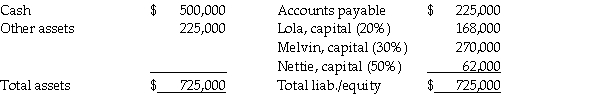

Lola, Melvin, and Nettie are in the process of liquidating their partnership. Since it may take several months to convert the other assets into cash, the partners agree to distribute all available cash immediately, except for $12,000 that is set aside for contingent expenses. The balance sheet and residual profit and loss sharing percentages are as follows:

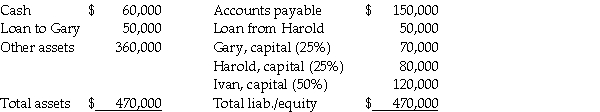

-The year-end balance sheet and residual profit and loss sharing percentages for the Gary, Harold, and Ivan partnership on December 31, 2014, are as follows:  The partners agree to liquidate the business and distribute cash when it becomes available. A cash distribution plan is developed with vulnerability rankings for the Gary, Harold and Ivan partnership. After outside creditors are paid, the cash available will initially go to

The partners agree to liquidate the business and distribute cash when it becomes available. A cash distribution plan is developed with vulnerability rankings for the Gary, Harold and Ivan partnership. After outside creditors are paid, the cash available will initially go to

Definitions:

Pulmonary Edema

The accumulation of fluid in the lungs' air sacs, leading to breathing difficulties.

Respiratory Membrane

The thin barrier through which gas exchange occurs between the alveolar air and the blood in the lungs.

Alveolar Epithelium

The thin layer of cells that lines the alveoli (air sacs) in the lungs, playing a key role in the exchange of oxygen and carbon dioxide.

Vital Capacity

Greatest volume of air that can be exhaled from the lungs after a maximum inspiration.

Q10: The IRS will not issue advanced rulings

Q11: At any point in time, a government

Q13: Shalles Corporation, a 80%-owned subsidiary of Pani

Q25: Plymouth Corporation (a U.S. company) began operations

Q29: Travel status requires that the taxpayer be

Q30: Willborough County had the following transactions in

Q32: A U.S. parent corporation loans funds to

Q38: Shebing Corporation had $80,000 of $10 par

Q38: International accounting standards differ from U.S. Generally

Q59: Samuel, age 53, has a traditional deductible