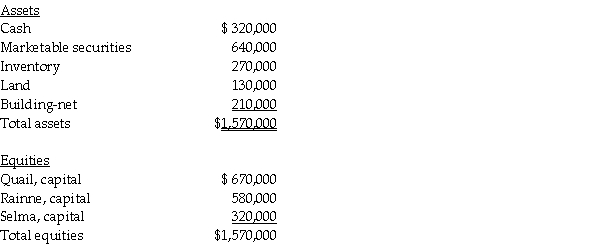

A summary balance sheet for the partnership of Quail, Rainne and Selma on December 31, 2014 is shown below. Partners Quail, Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

The partners agree to admit Trask for a one-tenth interest. The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

The partners agree to admit Trask for a one-tenth interest. The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

Required:

1. Record the entry to revalue the partnership assets prior to the admission of Trask.

2. Calculate how much Trask will have to invest to acquire a 10% interest.

3. Assume the partnership assets are not revalued. If Trask paid $300,000 to the partnership in exchange for a 10% interest, what would be the bonus that is allocated to each partner's capital account?

Definitions:

Stranger Phase

The initial phase in Leader-Member Exchange (LMX) theory where the leader and the subordinate start their relationship with formal interactions based on organizational roles.

Leadership Making

The process of developing leadership qualities within an individual or group, often through mentoring and experience.

Leader-Member Exchange Theory

A theory suggesting that leaders develop unique one-to-one relationships with each of the people reporting to them.

In-Groups

Social groups to which an individual feels a sense of belonging and identity, often distinguished by certain characteristics or interests.

Q9: Distributions from a Roth IRA that are

Q14: On January 1, 2014, Paar Incorporated paid

Q20: John Doe's will states that all assets

Q20: Sandpiper Corporation paid $120,000 for annual property

Q22: On January 2, 2013, Pilates Inc. paid

Q23: Paskin Corporation's wholly-owned Canadian subsidiary has a

Q24: Powell Corporation acquired 90% of the voting

Q24: The partnership of May, Novem, and Octo

Q29: With respect to exchange rates, which of

Q33: Sadie Corporation's stockholders' equity at December 31,