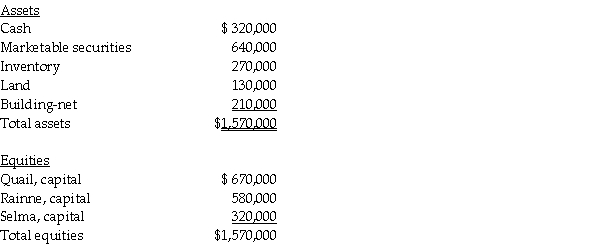

A summary balance sheet for the partnership of Quail, Rainne and Selma on December 31, 2014 is shown below. Partners Quail, Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

The partners agree to admit Trask for a one-tenth interest. The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

The partners agree to admit Trask for a one-tenth interest. The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

Required:

1. Record the entry to revalue the partnership assets prior to the admission of Trask.

2. Calculate how much Trask will have to invest to acquire a 10% interest.

3. Assume the partnership assets are not revalued. If Trask paid $300,000 to the partnership in exchange for a 10% interest, what would be the bonus that is allocated to each partner's capital account?

Definitions:

Nominal Variables

Variables that represent categories with no intrinsic ranking or order, such as gender, nationality, or brand names.

Degrees of Freedom

The number of values in a calculation that are free to vary without violating any constraints.

Contingency Table

A tabular method to display the frequency distribution of variables along with their joint distribution.

Contingency Table

A type of table used in statistics to summarize the relationship between two categorical variables, showing the frequency of various combinations of outcomes.

Q2: Assume you are preparing journal entries for

Q10: Which of the following does not occur

Q21: Centralized data processing, central motor pools and

Q23: The Leo, Mark and Natalie Partnership had

Q28: All of the following factors would be

Q30: On January 2, 2014, Paleon Packaging purchased

Q33: For internal decision-making purposes, Dashwood Corporation's operating

Q38: Parrot Corporation acquired 90% of Swallow Co.

Q68: If a taxpayer uses regular MACRS for

Q93: An election to use straight-line under ADS