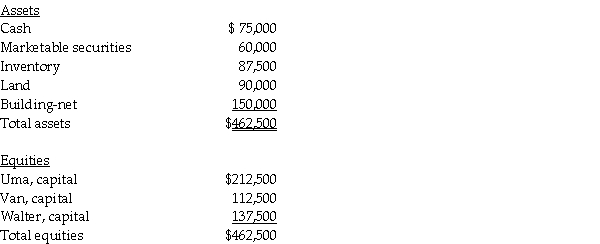

A summary balance sheet for the Uma, Van, and Walter partnership on December 31, 2014 is shown below. Partners Uma, Van, and Walter allocate profit and loss in their respective ratios of 4:5:7. The partnership agreed to pay Walter $227,500 for his partnership interest upon his retirement from the partnership on January 1, 2015. Any payments exceeding Walter's capital balance are treated as a bonus from partners Uma and Van.

Required:

Required:

Prepare the journal entry to reflect Walter's retirement.

Definitions:

BFOQ

Short for Bona Fide Occupational Qualification; a legal defense that allows an employer to consider characteristics typically off-limits, such as age or sex, when they are reasonably necessary to the operation of the business.

Yellow-Dog Contracts

Employment agreements where the employee agrees not to join or support a labor union during the tenure of employment.

Union Member

An individual who is part of a union, an organization that represents and advocates for workers' rights and interests.

Workers' Compensation Claim

A legal action filed by an employee to receive benefits after suffering an injury or illness directly related to their job duties.

Q1: Pool Industries paid $540,000 to purchase 75%

Q4: Pawl Corporation acquired 90% of Snab Corporation

Q7: Voluntary health and welfare organizations must report

Q7: The City's municipal golf course had the

Q10: The SEC requires push-down accounting for SEC

Q20: As to meeting the time test for

Q32: On November 1, 2014, Moddel Company (a

Q72: During the year, Walt went from Louisville

Q84: In contrasting the reporting procedures of employees

Q121: Which, if any, of the following expenses