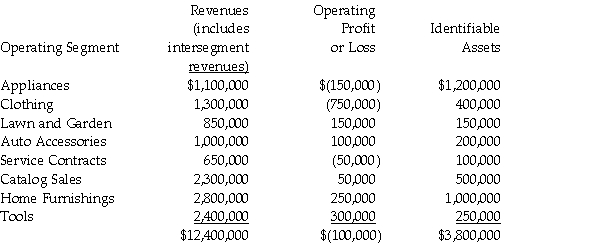

For internal decision-making purposes, Dashwood Corporation's operating segments have been identified as follows:

Revenues of the segments are external, with the exception of tools, which sold $400,000 to other segments, and Appliances, which sold $200,000 to other segments.

Revenues of the segments are external, with the exception of tools, which sold $400,000 to other segments, and Appliances, which sold $200,000 to other segments.

Required:

1. In applying the "revenue" test to identify reporting segments, what is the test value for Dashwood Corporation?

2. Using the "revenue" test, which of Dashwood's operating segments will also be reportable segments?

Definitions:

State Unemployment Taxes

Taxes imposed by state governments on employers to fund unemployment insurance benefits for laid-off workers.

Hourly Wage Rate

The amount of money paid for each hour of work performed.

Federal Income Tax Withholding

Federal income tax withholding is the process by which an employer deducts a portion of an employee's income to pay directly to the federal government as a prepaid credit towards the employee’s annual tax liability.

Contingent Liabilities

Potential obligations that may arise from past events, depending on the outcome of future events.

Q8: When recording an approved budget into the

Q12: A small town in a rural area

Q14: Peking County incurred the following transactions during

Q17: The XYZ partnership provides a 10% bonus

Q24: At December 31, 2014, an Enterprise Fund

Q33: The balance sheet of the Ama, Bade,

Q39: Prepare journal entries to record the following

Q47: If 150% declining-balance is used, there is

Q63: There is no cutback adjustment for meals

Q139: Rod uses his automobile for both business