Krull Corporation is preparing its interim financial statements for the third quarter of calendar 2014.

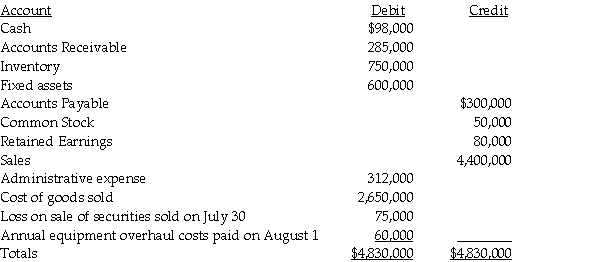

The following trial balance information is available for third quarter:

Additional information

Additional information

At the end of the year, Krull distributes annual employee bonuses and charitable donations that are estimated at $40,000, and $12,000, respectively. The cost of goods sold includes the liquidation of a $45,000 base layer in inventory that Krull will restore in the fourth quarter at a cost of $75,000. Effective corporate tax rate for 2014 is 32%.

Required:

Prepare Krull's interim income statement for the third quarter of calendar 2014.

Definitions:

Standard Cost Variances

The differences between the expected standard costs of manufacturing a product and the actual costs incurred.

Work in Process Inventories

Partially completed goods that are still undergoing the production process.

Standard Fixed Manufacturing Overhead Rate

This refers to the predetermined rate at which fixed manufacturing overhead costs are allocated to units of production, based on an expected level of activity.

Work in Process

Goods in various stages of production, not yet completed but not as raw materials, within a manufacturing process.

Q6: The tax law specifically provides that a

Q8: Blue Corporation, a U.S. manufacturer, sold goods

Q15: In terms of income tax treatment, what

Q15: On January 1, 2014, Pinnead Incorporated paid

Q29: The proper sequence of events is<br>A) purchase

Q31: Gains or losses on foreign currency transactions

Q36: On July 17, 2012, Kevin places in

Q37: Pond Corporation uses the fair value method

Q53: On July 10, 2012, Ariff places in

Q159: For tax purposes, "travel" is a broader