Use the following information to answer the question(s) below.

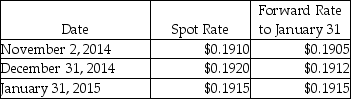

On November 2, 2014, Bellamy Corporation sells product to their Danish customer. At the same time, Bellamy signed a forward contract to sell 200,000 Danish krone in ninety days to hedge the account receivable at $0.1905, the 90-day forward rate. The receivable is expected to be collected in ninety days. Assume the forward contract will be settled net and this is a fair value hedge. The related exchange rates are shown below:

-Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on December 31?

Definitions:

Capital Intensive

Describes industries or businesses that require a large amount of capital investment in relation to their labor cost to produce goods and services.

Four Seasons Hotel

A luxury hotel chain known for its high-quality service and accommodations, catering to guests with upscale amenities.

Ford Manufacturing

The production processes and strategies used by the Ford Motor Company, known for innovations like the assembly line which revolutionized mass production.

Exit Strategy

A planned approach to exiting a business venture, typically to realize a profit or limit losses.

Q2: Wilhelman University, a not-for-profit, nongovernmental university, had

Q3: Plum Corporation paid $700,000 for a 40%

Q7: Regarding research and experimental expenditures, which of

Q14: On January 5, 2014, Eagle Corporation paid

Q26: On November 1, 2013, Ironside Company (a

Q28: Which type of fund is used to

Q28: Slickton Corporation, a U.S. holding company, enters

Q29: Noncontrolling interest share was reported in the

Q39: Assume Paris's inventory account had a book

Q77: MACRS depreciation is used to compute earnings