Use the following information to answer the question(s) below.

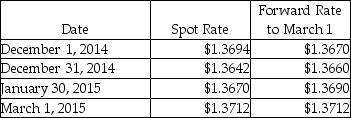

On December 1, 2014, Thomas Company, a U.S. corporation, purchases inventory from a vendor in Italy for 400,000 euros. Payment is due in 90 days. To hedge the transaction, Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670. Thomas uses a discount rate of 6% (present value factor for 30 days = .9950; 60 days = .9901; 90 days = .9851) . Assume the forward contract will be settled net and this is a cash flow hedge. Currency exchange rates are shown below:

-What is the fair value of the forward contract at January 30?

Definitions:

Unconditioned Stimulus

In classical conditioning, this refers to a stimulus that naturally and automatically triggers a response without any prior learning.

Neutral Stimulus

A stimulus that initially produces no specific response other than focusing attention, which can become a conditioned stimulus when used in classical conditioning.

Unconditioned Stimulus

In classical conditioning, an event that elicits a natural, reflexive response without the necessity of prior learning.

Conditioned Response

A learned response to a previously neutral stimulus that has become associated with an unconditioned stimulus through conditioning.

Q2: What is the fair value of the

Q8: Under the automatic mileage method, one rate

Q16: Allowing for the cutback adjustment (50% reduction

Q19: Interest payments on loans outstanding that do

Q22: On January 2, 2013, Slurg Corporation paid

Q26: Match the statements that relate to each

Q27: Which one of the following statements is

Q29: In a not-for-profit, private university, the federal

Q85: Orange Corporation begins business on April 2,

Q104: In which, if any, of the following