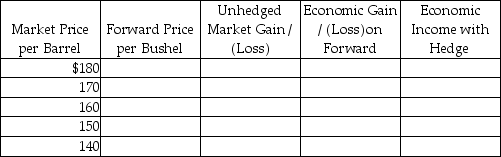

In September of 2014, Gunny Corporation anticipates that the price of heating oil will increase soon, and wishes to lock in a firm price for the winter months. They enter into a forward contract with Selton Industries to buy 100,000 barrels of oil at $160 per barrel in December 2014. Selton's cost of production of the heating oil is $120 per barrel.

Required:

Determine the economic impact of the transaction to Selton (the seller of the heating oil) at the market price levels indicated in the table below, with and without the hedge.

Definitions:

Q1: A trust fund was created to assist

Q9: The fixed assets and long-term liabilities associated

Q16: On January 1, 2011, a Voluntary Health

Q16: Dip Corporation is in a Chapter 11

Q17: The following information was taken from the

Q25: In terms of meeting the distance test

Q35: GAAP requires that segment information be reported<br>A)

Q37: For internal decision-making purposes, Elom Corporation's operating

Q72: During the year, Walt went from Louisville

Q103: White Company acquires a new machine (seven-year