Use the following information to answer the question(s) below.

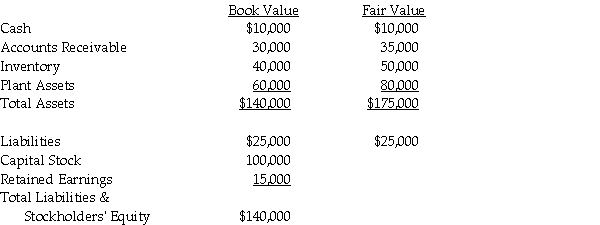

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

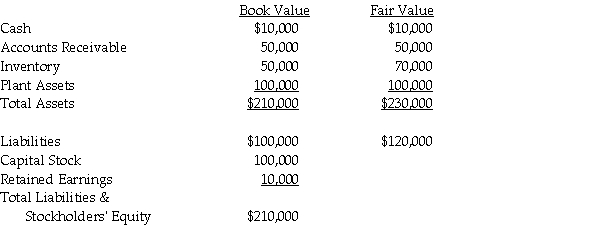

-On January 1, 2014, Brody Company acquired an 80% interest in Kristin Company for $240,000 cash. On January 1, 2014, Kristin Company had the following assets and liabilities:

Push-down accounting is used for the acquisition. Both companies use the entity theory.

Push-down accounting is used for the acquisition. Both companies use the entity theory.

Required:

1. What is the goodwill associated with Kristin Company on January 1, 2014?

2. Prepare the journal entry(ies) on Kristin's books on January 1, 2014.

3. Prepare the journal entry(ies) on Brody's books on January 1, 2014.

4. Prepare the elimination entry(ies) on the consolidating working papers on January 1, 2014.

Definitions:

Accounting Process

A systematic method of recording, summarizing, and reporting a company's financial transactions.

Financial Information

Data related to the financial status and operations of an entity, including assets, liabilities, revenue, and expenses.

Sole Proprietorships

Sole Proprietorships are businesses owned and operated by a single individual, with no legal distinction between the owner and the business.

Sarbanes-Oxley Act

A U.S. law enacted in 2002 to protect investors from fraudulent financial reporting by corporations.

Q5: Assume Paris's land account had a book

Q5: If a U.S. company wants to hedge

Q6: Government-wide financial statements exclude the<br>A) general fund.<br>B)

Q6: Bounty County had the following transactions in

Q7: A subsidiary has dilutive securities outstanding that

Q19: Interest payments on loans outstanding that do

Q34: Which fund would most likely report depreciation

Q38: Match the following definitions to the appropriate

Q40: Tommy, an automobile mechanic employed by an

Q100: Which of the following expenses, if any,