Use the following information to answer the question(s) below.

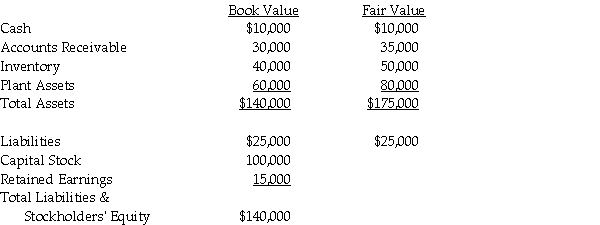

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

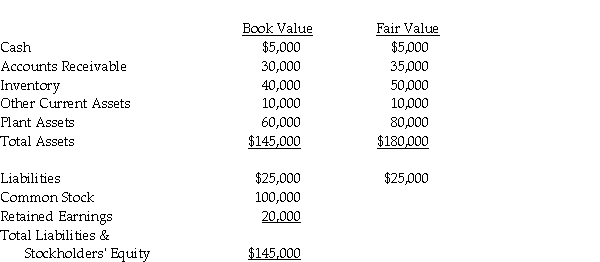

-On January 1, 2014, Gregory Company acquired a 90% interest in Subway Company for $200,000 cash. On January 1, 2014, Subway Company had the following assets and liabilities:

The plant assets have 20 years of useful life remaining. Straight-line depreciation is used. The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

The plant assets have 20 years of useful life remaining. Straight-line depreciation is used. The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

In 2014, Subway reported net income of $35,000 and declared and paid common dividends of $10,000. Gregory reported Income from Subway in 2014 of $17,100.

Required:

Assume both companies use the entity theory. Prepare the elimination entry(ies) on consolidating work papers for the year ending December 31, 2014.

Definitions:

Finished Goods Inventory

The stock of completed products that are ready to be sold but have not yet been sold.

Factory Overhead Cost

All indirect costs associated with manufacturing, such as maintenance and cleaning of equipment, which cannot be directly traced back to the production of specific goods.

Manufacturing Process

The sequence of operations or techniques used to transform raw materials or components into finished goods.

Insurance

A contract (policy) in which an individual or entity receives financial protection or reimbursement against losses from an insurance company.

Q2: The following are transactions for the city

Q9: The partnership of Dolla, Earl, and Festus

Q9: For the year ending December 31, 2014,

Q26: The key focus of government fund accounting

Q33: The financial statements of a proprietary fund

Q34: In 2012, Wally had the following insured

Q35: GAAP requires that segment information be reported<br>A)

Q49: Losses on rental property are classified as

Q120: Dave is the regional manager for a

Q155: Madison is an instructor of fine arts