Use the following information to answer the question(s) below.

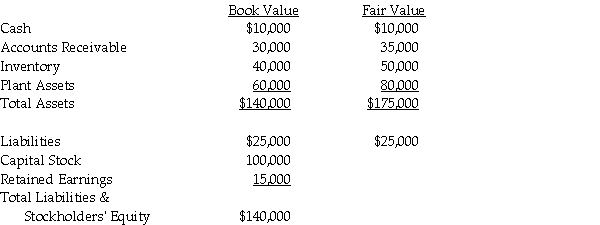

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

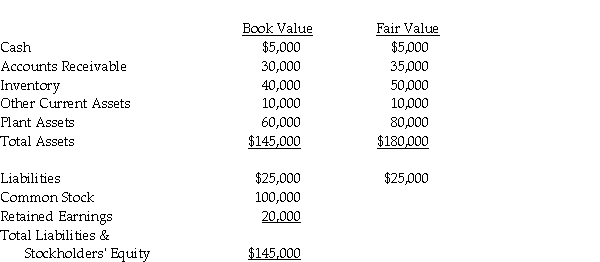

-On January 1, 2014, Gregory Company acquired a 90% interest in Subway Company for $200,000 cash. On January 1, 2014, Subway Company had the following assets and liabilities:

The plant assets have 20 years of useful life remaining. Straight-line depreciation is used. The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

The plant assets have 20 years of useful life remaining. Straight-line depreciation is used. The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

In 2014, Subway reported net income of $35,000 and declared and paid common dividends of $10,000. Gregory reported Income from Subway in 2014 of $17,100.

Required:

Assume both companies use the entity theory. Prepare the elimination entry(ies) on consolidating work papers for the year ending December 31, 2014.

Definitions:

Unrecaptured 1250 Gain

A type of gain on the sale of depreciable real property that’s taxed at a different rate than other capital gains.

Depreciation

The systematic allocation of an asset's cost over its useful life, reflecting its loss of value over time.

Gift Tax

A levy imposed on the act of transferring property from one person to another without receiving full value or any compensation in return.

Purchase Price

The amount of money paid to buy a good, service, or asset; fundamental in calculating the basis for investment or tax purposes.

Q2: On March 1, 2012, Lana leases and

Q10: Note to Instructor: This exam item is

Q12: Pasten Corporation is liquidating under Chapter 7

Q13: Required:<br>1. Prepare a schedule to allocate income

Q19: Alitech Corporation is liquidating under Chapter 7

Q24: John had adjusted gross income of $60,000.During

Q27: Pashley Corporation purchased 75% of Sargent Corporation

Q29: Noncontrolling interest share was reported in the

Q51: Two years ago, Gina loaned Tom $50,000.

Q56: Al single, age 60, and has gross