Use the following information to answer the question(s) below.

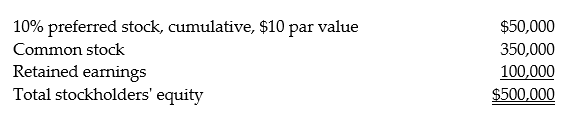

On December 31, 2013, Parminter Corporation owns an 80% interest in the common stock of Sanchez Corporation and an 80% interest in Sanchez's preferred stock. On December 31, 2013, Sanchez's stockholders' equity was as follows: On December 31, 2013, preferred dividends are not in arrears. Sanchez had 2014 net income of $30,000 and only preferred dividends are declared and paid in 2014. There are no book value/fair value differentials associated with Parminter's investments.

On December 31, 2013, preferred dividends are not in arrears. Sanchez had 2014 net income of $30,000 and only preferred dividends are declared and paid in 2014. There are no book value/fair value differentials associated with Parminter's investments.

-How much should the Parminter's Investment in Sanchez-Common Stock,change during 2014?

Definitions:

Total Taxes

The combined amount of all taxes levied by a government on individuals, corporations, and other entities.

Tax Rate Structure

The organization of tax rates into different brackets or categories, which determines the amount of tax levied on income, property, sales, etc.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, placing a higher burden on wealthier individuals.

Tax Incidence

The ultimate distribution of a tax burden.

Q1: Under the modified accrual basis of accounting,

Q2: Enterprise funds are accounted for in a

Q5: The following are transactions for the city

Q7: In partnership liquidations, what are safe payments?<br>A)

Q22: Lesher Corporation lost their primary contract and

Q37: The General Fund transfers $50,000 cash to

Q38: Which of the following conditions would not

Q40: CommTex Corporation is liquidating under Chapter 7

Q50: The cash method can be used even

Q97: The expenses incurred to investigate the expansion