Use the following information to answer the question(s) below.

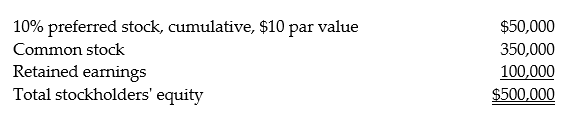

On December 31, 2013, Parminter Corporation owns an 80% interest in the common stock of Sanchez Corporation and an 80% interest in Sanchez's preferred stock. On December 31, 2013, Sanchez's stockholders' equity was as follows: On December 31, 2013, preferred dividends are not in arrears. Sanchez had 2014 net income of $30,000 and only preferred dividends are declared and paid in 2014. There are no book value/fair value differentials associated with Parminter's investments.

On December 31, 2013, preferred dividends are not in arrears. Sanchez had 2014 net income of $30,000 and only preferred dividends are declared and paid in 2014. There are no book value/fair value differentials associated with Parminter's investments.

-What should be the noncontrolling interest share,preferred in the consolidated financial statements of Parminter for the year ending December 31,2014?

Definitions:

Principal of an Estate

The total assets of an estate before debts and liabilities are subtracted.

Major Repairs

Significant restorations or overhauls to property or equipment, intended to extend its useful life or enhance its value.

Ordinary Repair

Maintenance activities conducted regularly to keep assets in their current condition and prevent significant deterioration.

Taxable Estate

The total value of an individual’s estate that is subject to estate tax after deductions such as debts, funeral expenses, and charitable donations.

Q2: On October 15, 2014, Napole Corporation, a

Q4: Regarding § 222 (qualified higher education deduction

Q7: Which condition must be met for fresh-start

Q12: Which statement below is incorrect with respect

Q20: What partnership capital will Robert have after

Q23: The Leo, Mark and Natalie Partnership had

Q29: Picasso Co. issued 5,000 shares of its

Q48: In 2011, Tan Corporation incurred the following

Q80: Intangible drilling costs may be expensed rather

Q97: The expenses incurred to investigate the expansion