Use the following information to answer the question(s) below.

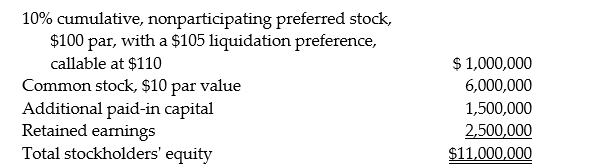

On January 1, 2014, Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows: There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1, 2014. There are no book value/fair value differentials.

-Assume Salter's net income for 2014 is $220,000.No dividends are declared or paid in 2014.What is the change in Pardy's Investment in Salter for the year ending December 31,2014?

Definitions:

Motion

Describes the change in position of an object with respect to time and its surroundings.

Lungs

Pair of respiratory organs located in the thorax, responsible for exchanging oxygen and carbon dioxide between the blood and the environment.

Breathing Air

The act of inhaling oxygen from the atmosphere and exhaling carbon dioxide, essential for the survival of terrestrial organisms.

Month

A unit of time, roughly corresponding to the length of one complete cycle of the moon's phases, used in calendars to divide the year.

Q1: A trust fund was created to assist

Q11: A taxpayer who lives and works in

Q18: Required:<br>1. Prepare a schedule to allocate income

Q22: What will the profit and loss sharing

Q28: The following data relate to Elle Corporation's

Q31: How much cash would Baker receive from

Q36: Which of the following assets and/or liabilities

Q48: Statutory employees:<br>A) Report their expenses on Schedule

Q57: Ethan, a bachelor with no immediate family,

Q116: Which of the following is incorrect?<br>A)Alimony is