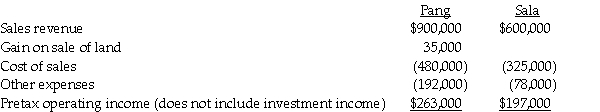

Pretax operating incomes of Pang Corporation and its 70%-owned subsidiary, Sala Corporation, for the year 2014, are shown below. Sala pays total dividends of $60,000 for the year. There are no unamortized book value/fair value differentials relating to Pang's investment in Sala. During the year, Pang sold land to Sala for a gain of $35,000 and Sala holds this land at the end of the year. The marginal corporate tax rate for both corporations is 34%.

Required:

Required:

1. Determine the separate amounts of income tax expense for Pang and Sala as if they had filed separate tax returns.

2. Determine Pang's net income from Sala.

Definitions:

Nonnormal

Refers to data distributions that do not follow a normal distribution, often characterized by skewness or a lack of symmetry.

Randomly Selected

A process of selection in which each member of a set has an equal probability of being chosen.

Probability P

The likelihood of a specific event occurring, often denoted as a number between 0 and 1.

Standard Deviation

A statistic that measures the dispersion or variability of a dataset relative to its mean, indicating how spread out the data points are.

Q3: What funds are reported in Government-wide financial

Q4: The balance sheet of the Park, Quid,

Q6: In 2012, Theo, an employee, had a

Q16: Allowing for the cutback adjustment (50% reduction

Q25: Plymouth Corporation (a U.S. company) began operations

Q26: Entities other than the primary beneficiary account

Q31: Krull Corporation is preparing its interim financial

Q54: A cash basis taxpayer can deduct the

Q74: Doug purchased a new factory building on

Q85: Match the statements that relate to each