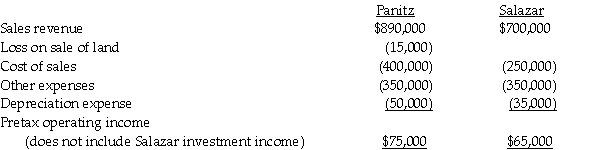

Pretax operating incomes of Panitz Corporation and its 80%-owned subsidiary, Salazar Corporation, for the year 2014, are shown below.

Panitz and Salazar belong to an affiliated group. Salazar pays total dividends of $35,000 for the year. There are no unamortized book value/fair value differentials relating to Panitz's investment in Salazar. During the year, Panitz sold land to Salazar at a total loss of $15,000 which is included in its pretax operating income. Salazar still holds this land at the end of the year. The marginal corporate tax rate for both corporations is 34%.

Required:

Required:

1. Determine the separate amounts of income tax expense for Panitz and Salazar as if they had filed separate tax returns.

2. Determine Panitz's net income from Salazar.

Definitions:

Lymphocyte Levels

Measurements of the amount of lymphocytes, a type of white blood cell, which play a significant role in the body's immune defense mechanisms.

Collective Settlements

Agreements or resolutions reached by a group, often in the context of legal negotiations or disputes.

Emotion-Focused Coping

A coping strategy that involves trying to reduce the negative emotional responses associated with stress, such as by seeking support or reinterpreting the problem.

Aerobic Exercise

Physical activity that increases heart rate and the body's use of oxygen, improving cardiovascular fitness, such as running, cycling, or swimming.

Q6: Cole Company has the following 2014 financial

Q10: Which of the following procedures is acceptable

Q16: Dip Corporation is in a Chapter 11

Q18: Required:<br>1. Prepare a schedule to allocate income

Q18: The accounting equation for a governmental fund

Q23: A corporation which makes a loan to

Q24: Snodberry Catering has five operating segments, as

Q26: The accountant for Baxter Corporation has assigned

Q30: Willborough County had the following transactions in

Q37: Gains and losses incurred at liquidation are