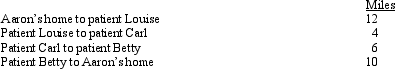

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Central Planning

A system where the government or a centralized authority makes all decisions about the production and distribution of goods and services.

Industry Output

The total production of goods and services by all firms in a particular industry over a specific time period.

Chain Reaction

A sequence of reactions where a reactive product or by-product causes additional reactions to take place, often leading to a self-sustaining series of events.

Enterprise Success

The achievement of desired business outcomes, such as profitability, market share growth, and innovation.

Q2: What is the fair value of the

Q5: Susan has the following items for 2012:<br>·

Q14: If an employer pays for the employee's

Q18: Required:<br>1. Prepare a schedule to allocate income

Q51: A taxpayer who uses the automatic mileage

Q92: A nonbusiness bad debt deduction can be

Q96: Blue Corporation incurred the following expenses in

Q101: Felicia, a recent college graduate, is employed

Q116: Qualified moving expenses of an employee that

Q136: Janet, who lives and works in Newark,