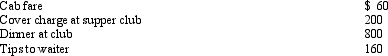

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation, Henry's deduction is:

Presuming proper substantiation, Henry's deduction is:

Definitions:

Entitlement Pay

Financial compensation granted to employees based on their title, status, or seniority rather than their performance or productivity.

Intrinsic Rewards

Refers to the internal and psychological rewards individuals receive from engaging in activities that are inherently satisfying or fulfilling.

Symbolic Tokens

Items, gestures, or actions used to represent or signify larger concepts, beliefs, or values.

Work Setting

The physical and social environment in which professional duties are carried out.

Q13: "Other casualty" means casualties similar to those

Q22: James purchased a new business asset (three-year

Q23: A corporation which makes a loan to

Q24: A highly-effective hedge of an existing asset

Q24: For self-employed taxpayers, travel expenses are not

Q46: For a person who is in the

Q50: The cash method can be used even

Q113: Robin and Jeff own an unincorporated hardware

Q146: During the year, Peggy went from Nashville

Q161: Alexis (a CPA and JD) sold her