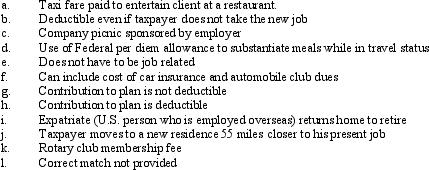

Match the statements that relate to each other.(Note: Choice L may be used more than once.)

Definitions:

Revenue Accounts

Accounts that track the income generated from normal business operations, including sales revenue, service revenue, and interest revenue.

Credits

Accounting entries that increase liabilities or equity or decrease assets, representing the opposite of debits.

Owner Invests

occurs when the owner of a business contributes assets, commonly in the form of cash or equipment, into the business for its use.

Retained Earnings

The portion of a company's profits that is kept or retained and not paid out as dividends to shareholders, often used for reinvestment.

Q19: James, a cash basis taxpayer, received the

Q42: Cream, Inc.'s taxable income for 2012 before

Q68: Under what circumstances may a taxpayer deduct

Q79: On March 3, 2012, Sally purchased and

Q97: The exclusion for health insurance premiums paid

Q100: Melody works for a company with only

Q105: The cost recovery period for new farm

Q131: A taxpayer who lives and works in

Q143: Which, if any, of the following expenses

Q144: If a taxpayer does not own a