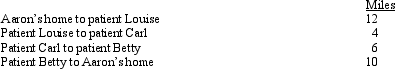

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Smart Technologies

Integrated systems that utilize machine learning, IoT, and automation to improve efficiency, convenience, and decision-making processes.

Privacy Rights

The rights of individuals to control or influence what information related to them may be collected and used.

Legal Questions

Pertains to inquiries that involve interpretations of law or legal principles, typically requiring expertise in legal matters.

Technology

The application of scientific knowledge for practical purposes, especially in industry and our daily lives, encompassing everything from gadgets to complex systems.

Q7: Greta, Harriet, and Ivy have a retail

Q14: On January 5, 2014, Eagle Corporation paid

Q23: What is the proper disposition of a

Q26: The accountant for Baxter Corporation has assigned

Q35: On January 1, 2014, Bambi borrowed $500,000

Q36: On July 17, 2012, Kevin places in

Q63: If a taxpayer cannot satisfy the three-out-of-five

Q78: How are combined business/pleasure trips treated for

Q93: An election to use straight-line under ADS

Q102: Trade or business expenses are classified as