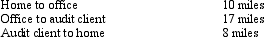

Bill is employed as an auditor by a CPA firm.On most days, he commutes by auto from his home to the office.During one month, however, he has an extensive audit assignment closer to home.For this engagement, Bill drives directly from home to the client's premises and back. Mileage information is summarized below:

If Bill spends 21 days on the audit, what is his deductible mileage?

If Bill spends 21 days on the audit, what is his deductible mileage?

Definitions:

Accounting Costs

The documented expenses and outlays involved in running a business, as recorded in its financial statements.

Economic Costs

The total cost of choosing one action over another, including both explicit costs (direct payments) and implicit costs (opportunity costs).

Price-Taker Market

A market structure where individual firms have no control over the price of their product, taking the market price as given.

Market Supply Curve

A graphical representation of the quantity of goods suppliers are willing to sell at different price levels.

Q5: Which, if any, of the following factors

Q18: What exchange gain or loss appeared on

Q20: Peyton Corporation owns an 80% interest in

Q22: Lesher Corporation lost their primary contract and

Q27: For tax years beginning in 2012, the

Q34: Jacana Company uses the LIFO inventory method.

Q40: A taxpayer may carry any NOL incurred

Q50: The maximum cost recovery method for all

Q58: During 2012, Eva used her car as

Q79: Nicole just retired as a partner in