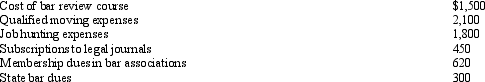

In the current year, Bo accepted employment with a Kansas City law firm after graduating from law school.Her expenses for the year are listed below:

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Since Bo worked just part of the year, her salary was only $32,100.In terms of deductions from AGI, how much does Bo have?

Definitions:

Accumulated Depreciation

The total amount of an asset's cost that has been allocated as depreciation expense since the asset was put into use.

Contra-Asset Account

An account shown on the balance sheet that reduces the value of a related asset, used for accumulated depreciation or allowances for doubtful accounts.

Depreciation Schedule

A table detailing the periodic depreciation expense of an asset over its useful life.

Worksheet

A document that accountants use for planning and preparing adjustments, showing the results of those adjustments before preparing financial statements.

Q9: For the year ending December 31, 2014,

Q16: Meric Corporation (a U.S. company) began operations

Q16: Are all personal expenses disallowed as deductions?

Q17: The following are transactions for the city

Q20: Peyton Corporation owns an 80% interest in

Q32: Al, who is single, has a gain

Q53: John files a return as a single

Q60: Kelly, an unemployed architect, moves from Boston

Q77: Qualifying job search expenses are deductible even

Q89: The portion of property tax on a