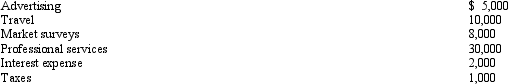

In 2012, Marci is considering starting a new business. Marci had the following costs associated with this venture:

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Marci started the new business on October 1, 2012. Determine the deduction for Marci's startup costs for 2012.

Definitions:

Periodic Amounts

Regularly scheduled payments or receipts over a defined period.

Interest

The cost of borrowing money or the return on investment for savings and investments, typically expressed as an annual percentage rate.

Liquidity Ratios

Financial metrics used to assess a company's ability to meet its short-term debt obligations, by comparing current assets to current liabilities.

Debt-Paying Ability

A financial metric used to gauge a firm's capacity to settle its obligations, often assessed through ratios such as the debt to equity or debt service coverage ratios.

Q5: On May 1, 2014, Listing Corporation receives

Q18: Once the more-than-50% business usage test is

Q41: Research and experimental expenditures do not include

Q59: Freddy purchased a certificate of deposit for

Q60: Kelly, an unemployed architect, moves from Boston

Q63: In 2004, Terry purchased land for $150,000.

Q101: Rachel, who is in the 35% marginal

Q105: A company has a medical reimbursement plan

Q110: Louise works in a foreign branch of

Q114: In January 2012, Tammy purchased a bond