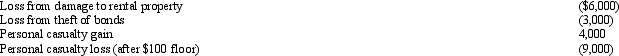

In 2012, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Exocytosis

A process in which cells expel materials from the cell interior into the extracellular space by vesicles merging with the plasma membrane.

Extracellular Matrix

A network of non-living tissues that provide structural and biochemical support to cells.

Proteins

Large biomolecules composed of amino acids, essential for structure, function, and regulation of the body's tissues and organs.

Polysaccharides

Large carbohydrate molecules composed of long chains of monosaccharide units bonded together, involved in energy storage and structural support.

Q9: Ulysses Company purchases goods from China amounting

Q22: Patch Corporation has a 50% undivided interest

Q25: Under GAAP, the _ will include the

Q29: Meg's employer carries insurance on its employees

Q36: On July 17, 2012, Kevin places in

Q49: Dan and Donna are husband and wife

Q82: In some foreign countries, the tax law

Q98: Briefly discuss the two tests that an

Q114: In January 2012, Tammy purchased a bond

Q128: During the year, Jim rented his vacation