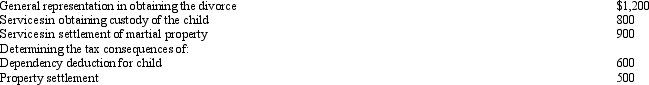

Velma and Josh divorced. Velma's attorney fee of $4,000 is allocated as follows:  Of the $4,000 Velma pays to her attorney, the amount she may deduct as an itemized deduction is:

Of the $4,000 Velma pays to her attorney, the amount she may deduct as an itemized deduction is:

Definitions:

Journal Entries

Entries made into an accounting ledger to document financial transactions, ensuring the debits equal the credits.

Voting Shares

Equity securities that grant the holder the right to vote on company matters, such as board elections and major corporate decisions.

Net Income

The net income of a business once all costs and taxes are subtracted from its total revenues.

Fair Value Through Other Comprehensive Income

A financial accounting method where certain assets are revalued periodically and changes are recorded in other comprehensive income.

Q35: Why are there restrictions on the recognition

Q46: Which of the following is not a

Q54: A cash basis taxpayer can deduct the

Q54: Under the Swan Company's cafeteria plan, all

Q71: If a vacation home is rented for

Q76: The Bard Estate incurs a $25,000 fee

Q79: Nicole just retired as a partner in

Q97: The expenses incurred to investigate the expansion

Q111: Janet purchased a new car on June

Q134: If an item such as property taxes